Just remember: You’re responsible for the full purchase amount whether payment requests are accepted or declined, and American Express is not responsible for ensuring that money is paid back. And in either scenario, you still receive all the eligible rewards for the purchase. If one of your co-workers only gets a drink, for instance, Amex divvies up the amounts and you can easily adjust so everyone pays just what they owe. Better yet, this feature can be even more useful when splitting uneven amounts. Split evenly, you end up paying only $20 after everyone pays you back, and the funds seamlessly go back to your card account. You put the $200 expense on your personal Credit Card and then use the Amex App to split up the amount and send out requests via Venmo and PayPal. The best part? You’ll get all the rewards you’d typically earn for the purchase – regardless of whether you earn Membership Rewards ® Points, miles, hotel points, or cash back.įor example, imagine you and nine of your co-workers go out to lunch. When those users pay you back, you can choose to get paid back directly to your Card Account as a statement credit, or to your linked Venmo or PayPal account. However, it’s important to remember that you won’t earn rewards when adding money to your Send Account.Ĭard Members can also seamlessly split their Amex Card purchases with other Venmo and PayPal users.

Most American Express Card Members can add up to $2,000, whereas those with The Platinum Card ® may add as much as $4,000, and those with The Centurion ® Card can add up to $5,000. Note that there are limits to the amount you can put on your Send Account. PayPal may charge for transactions outside the United States, however. Considering that fees are generally 3%, that can add up to notable savings – especially if you’re often paying back friends and family for dinner, drinks, or other purchases. Any balance loaded to your Send Account appears as a charge on your Credit Card and is subject to the APR of other purchases on your billing statement – in other words, it’s not treated as a cash advance, and you won’t have to pay cash advance fees.Īnd more good news – you won’t incur the standard credit card fees charged by Venmo or PayPal. You can then add money from your American Express Card to your “Amex Send ® Account” and then send that money to Venmo or PayPal users of your choosing.

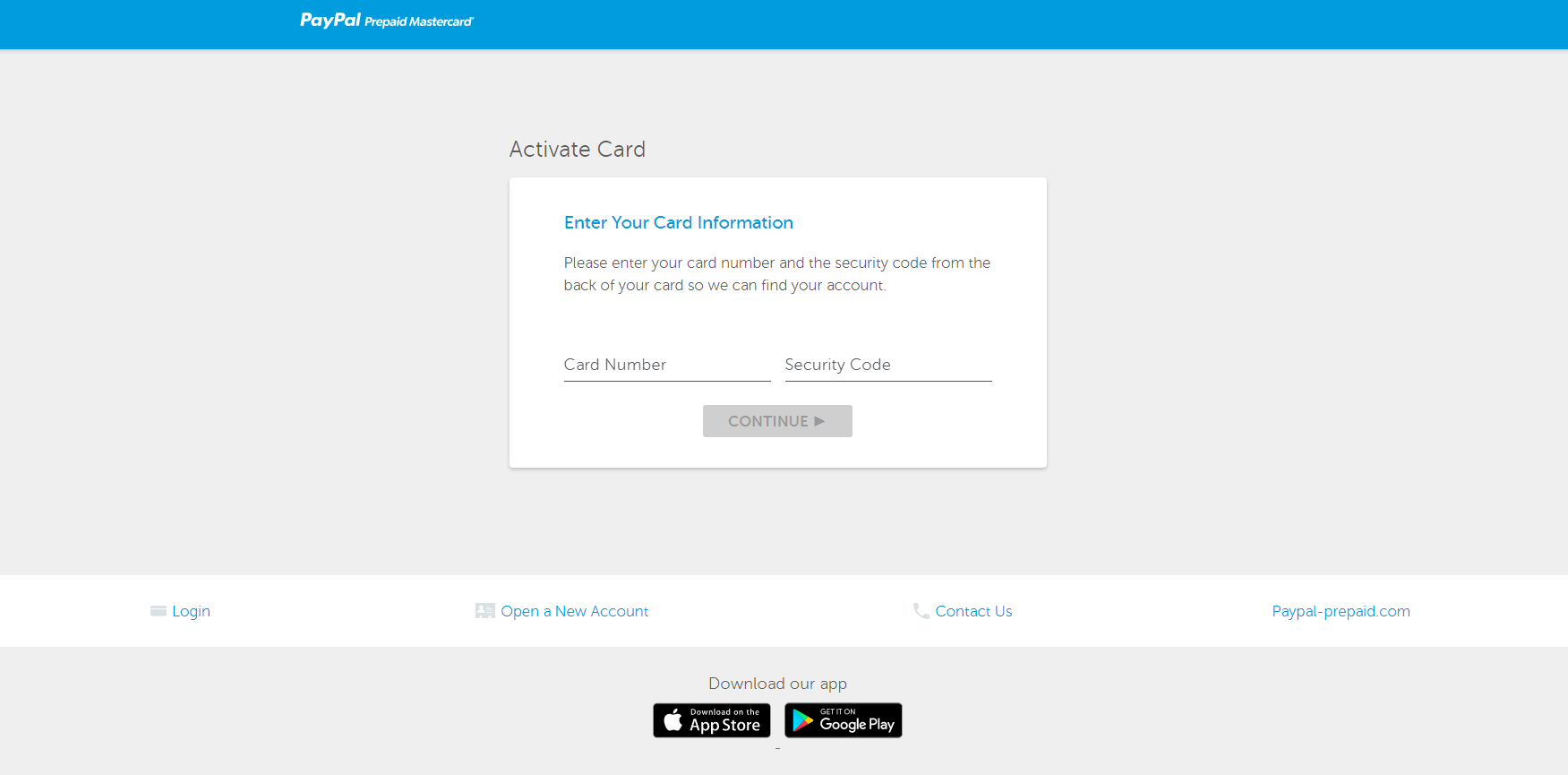

First, you’ll need to enroll in Send & Split ®, which can be found in the “Account” tab of the Amex App. See the Cardholder Agreement for details.Yes! Eligible Card Members can use the American Express App to send money to any Venmo or PayPal user. ** While this feature is available for free, certain other transaction fees and costs, terms, and conditions are associated with the use of this Card. See your Cardholder Agreement for details. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card. Your wireless carrier may charge a fee for message and data usage. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Unapproved checks will not be funded to your card. Fees apply for approved Money in Minutes transactions funded to your card. All checks are subject to approval for funding in Ingo Money’s sole discretion. Approval review usually takes 3 to 5 minutes but can take up to one hour. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions, and Privacy Policy. * Mobile Check Load is a service provided by First Century Bank, N.A.

#Paypal prepaid app android

If you have Android OS version 4.3 or lower, we recommend using the Online Account Center available at. The latest version of the PayPal Prepaid Mobile App requires Android version 4.4 and higher. It’s secure, fast, and best of all, free.**

0 kommentar(er)

0 kommentar(er)